As Ralph Estes (1996) has noted, many of the most important and valuable elements of an organization are assigned no economic value. It is only tangible entities, such as property, buildings, and equipment that can be considered the formal economic assets of an organization. Generally accepted accounting principles (GAAP) that rule contemporary accounting practices do not recognize less-tangible elements of an organization—such as its reputation, quality of work, levels of employee education and training—or trusting interpersonal and interorganizational relationships. You don’t find these intangible elements represented on an organization’s spreadsheet when leaders of this organization are applying for a loan or fulfilling accreditation requirements. The back log burns unacknowledged on the organization’s accounting fire—for most contemporary leaders pay exclusive attention pay to those burning logs that provide immediate heat and glow. This selective attention is inherent in their short-term “bottom line” perspective.

Adding the Odd-Shaped Log

Sometimes I like to place a big, odd-shaped log in the fire. It will help enliven the fire (providing new fuel and “virgin” edges that can readily catch on fire). For me, it also adds a new pattern of flames. The key question is: how will it be received by the other logs that are already burning in the fire? Other pieces of wood need to be burning very hot and there must be a good bed of embers if the new oddly shaped log is to contribute to the fire. Furthermore, the fire must be carefully monitored and tendered for a short while, as the new odd-shaped log begins to interact with the “established”, normally shaped logs that have been on the grate for a relatively long period of time or have been newly placed on the grate.

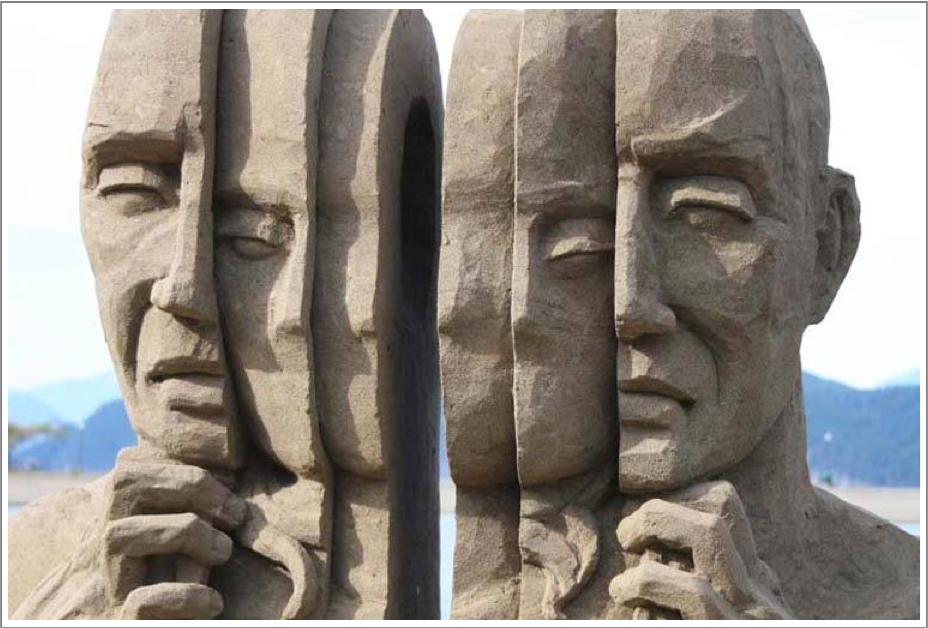

Sometimes the odd-shaped log needs to be repositioned if it is to flame up. This placement reminds me of organizational mergers (Galpin and Herndon, 2014). Mergers are often envisioned so that “logs” of different size and shape can be joined together to form a new, more powerful organization made up of complementary (though not always complimentary) parts. With this diversity of organizational form and functioning—offering an array of products or services—there is the promise of greater agility and broadening markets. The Medici Effect is fully in forced (or at least anticipated). While this envisioning is not always realistic, it certainly has been a driving force in recent years that has accelerated the use of mergers to solve organization’s problems.

Unfortunately, mergers are not always (or even often) the answer. Whatever problems exist in any one of the organizations often ‘infects” the other organization and both organizations share in the problem of size (which I described above). Mergers are typically only successful if at least one of the organizations is strong. When two weak organizations merge, they usually sink one another (pulling each other down so that both drown). Might this be the case with the merger of Sears and K-Mart? It is often quite a challenge to reposition the products or services aligned with at least one of the organizations that is involved in a merger. Did H-P do this repositioning of Compaq when these two organizations merged? What about the merger of AOL and Time-Warner, or Daimler-Benz and Chrysler? What can be learned about successful merging from these case studies?